Preparing to apply for a loan?

Here are some ways to get your finances ready.

1. Prepare a budget

A budget is an estimate of income and spending for a set period of time. The reason to have a budget is to help you achieve your financial goals. Your goals are personal to you - it could be to stay on top of bills or even buy a land lease home!

Moneysmart.gov.au provides a great budget tool.

Record your income. This money could be from your wages, pension, government benefit or payment, or income from investments.

Understand your spending - it can be easy to lose track of how you’re spending money, especially due to cashless payments and credit cards. Take a look at your bank statements and record your expenses.

2. Find where you can make savings

Many expenses can’t be avoided – but discretionary expenses can be reduced.

Consider:

- Meal planning and setting a budget for eating out/take-away.

- Paying off debts or credit cards completely each month.

- Buy only planned items within your allocated budget – then stop!

Check out our information on discretionary versus non-discretionary expenses below.

Have a go at making your own budget with the Moneysmart budget planner.

What is a balloon payment?

Here’s what it means.

A balloon payment is an agreed lump sum of money you repay to your lender at the end of your loan term. It allows you to reduce your regular repayments, in exchange for owing the lender a lump sum at the end of the loan term. Like a principal and interest loan, interest is still payable on the balloon amount, you are just not paying back the principal component until the end of the term.

The word ‘balloon’ is borrowed from the French word for inflated ball, because the lump sum is like an inflated payment.

A balloon payment can be useful if you have access to funds at the end of your loan term.

A Lifestyle PLUS land lease home loan the flexibility of an optional balloon payment, which is just one way Land Lease Home Loans can help you manage your repayments.

Please schedule a call with us to discuss your financial situation and see if our flexible payment options could work for you.

What is the difference between a discretionary expense and a non-discretionary expense?

Here’s what it means.

Let’s start with a non-discretionary expense. This type of expense is essential for daily living, such as a mortgage repayment or rent, utilities and groceries. These are the expenses that are largely unavoidable, you have to pay them.

A discretionary expense, on the other hand, refers to non-essential expenses, such as travel or hobbies, restaurants, alcohol, tobacco, coffee and takeaway food. These are the expenses you do have a choice over, you can control them.

Another way to think about it is needs versus wants. Needs are the non-discretionary expenses and the wants are discretionary expenses.

When applying for a loan it is important to have a good idea of your monthly expenses, both non-discretionary and discretionary.

Non-discretionary and discretionary expenses will be taken into consideration when assessing your loan application. Tracking discretionary expenses separately from non-discretionary expenses makes it easy to see where, and to what proportion, discretionary expenses could be reduced if your spending needs to be cut back.

A great way to understand your non-discretionary and discretionary expenses is to create a monthly budget. MoneySmart.gov.au has a fantastic Budget Planner to get you started. Don’t forget it is important to account for non-discretionary spending first while setting a budget.

What is LVR?

The finance industry is a wide, wondrous world with a language all of its own. One of the many acronyms bandied about is ‘LVR’, which stands for ‘loan-to-valuation ratio’.

Here’s what it means.

Lenders use LVR to provide customers with a guide of how much they will lend against the value of a home. It is the loan amount required to purchase the home expressed as a percentage of the value of the home.

For example, if the home you want to purchase is valued at $420,000, and you need to borrow $100,000 to pay for it, the loan is 24% of the home’s value, making your LVR 24%.

LVR is important because different lenders and loan types have different maximum LVRs.

The higher the lender’s maximum LVR the more a lender will lend against the value of your home and vice versa the lower the maximum LVR, the less a lender will lend against the value of your home.

You can use the calculators below as a guide to how much you can borrow from Land Lease Home Loans.

When can I access my super?

Here’s some information that might help you.

Generally speaking, you can withdraw your superannuation:

when you reach preservation age and retire;

when you turn 65 (even if you haven’t retired); or

under the transition to retirement rules, while continuing to work.

Superannuation laws provide specific rules for when you can access your super. These are called conditions of release.

There are also limited circumstances where you can access your super early. These are mainly related to specific medical conditions or severe financial hardship.

Your preservation age is not the same as your pension age.

The best place to find more information is www.ato.gov.au or contact your own super fund.

You should consider seeking independent legal and/or financial advice to check how this information relates to your unique circumstances.

What is my preservation age?

Here is some information to explain...

Your preservation age is the age you can access your super, if you are retired or start a transition to retirement income stream. Reaching your preservation age meets one of the conditions of release rules to access your superannuation.

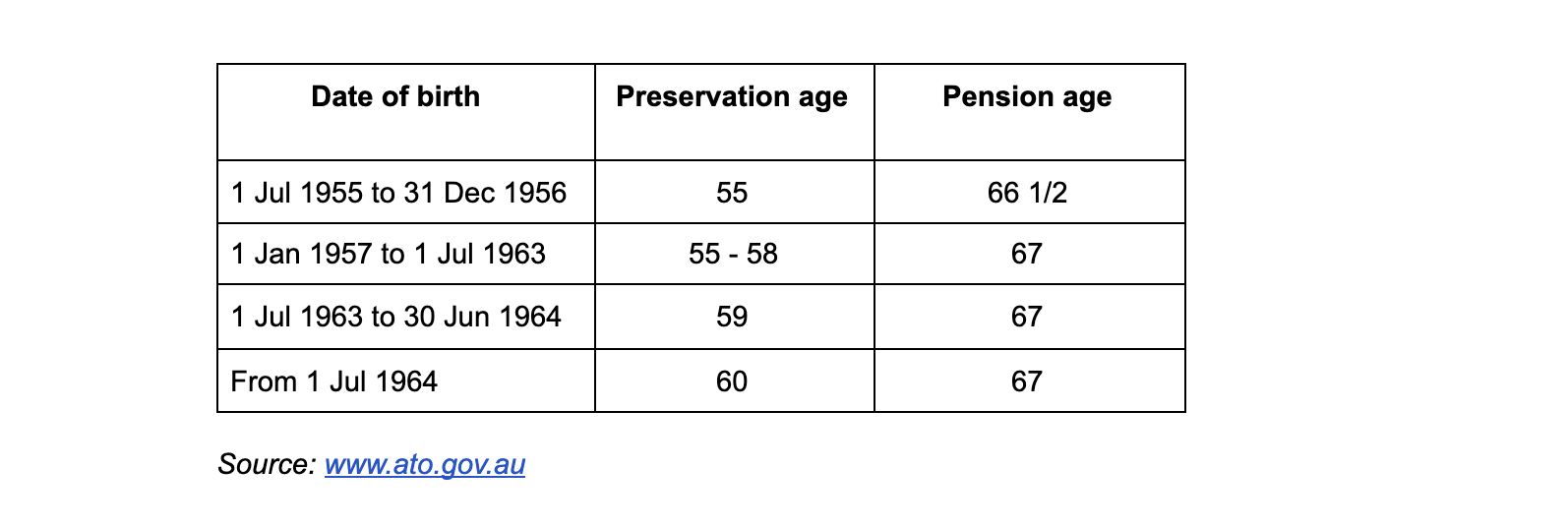

If you were born before 1 July 1963 you have already reached your preservation age. If you were born after 1 July 1963 then your preservation age depends on when you were born, as shown in the chart below.

You also meet a condition of release if you are over 65 years or are granted early access to your super (prior to preservation age) under special circumstances, such as for severe financial hardship, compassionate grounds, or incapacity.

Preservation age is not the same as pension age. On 1 July 2021, the Age Pension age increased to 66 years and 6 months for people born from 1 July 1955 to 31 December 1956, inclusive. If your birthdate is on or after 1 January 1957, you’ll have to wait until you turn 67. This will be the Age Pension age from 1 July 2023.

The best place to find more information is www.ato.gov.au or contact your own superannuation fund

IMPORTANT NOTICE: This information has been prepared without taking account of the needs, objectives, or financial situation of any particular individual. Applicants should consider their own circumstances and, if necessary, seek professional advice. Applications are subject to loan approval criteria. Terms, conditions, fees and charges apply.

Land Lease Home Loans Pty Ltd ACN 642 684 053 Australian Credit Licence 546781.